Click here to subscribe today or Login.

Great news! If you are planning on buying a car, Wilkes-Barre city is one of the places with the lowest average car loan in the nation.

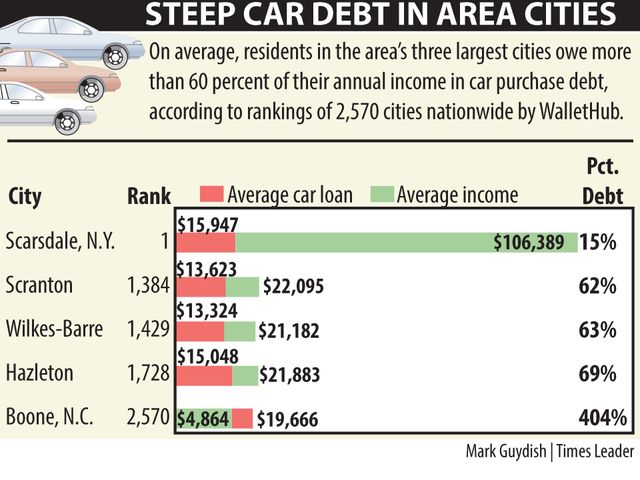

Average loans total a scant $13,324, 79th lowest in more than 2,500 cities reviewed in a new report.

Bad news! Wilkes-Barre’s average income of $21,182 is so low that car loans make up a huge part of it — 63 percent, ranking the city 1,429th on the same list when it comes to how affordable those car loans actually are.

It could be better. In a report dubbed “2016’s Cities that Overspend on Cars” by WalletHub, Scarsdale, N.Y., is the best place to borrow to buy a car. The average loan is slightly higher — $15,947 — but the income level is five times higher at $106,389, making the loan a scant 15 percent.

It could also be worse. WalletHub, which bills itself as the one-stop website for information “to make better financial decisions and save money,” ranked Boone, N.C., at 2,570, the bottom of the list. The reason? The average car loan of $19,666 is roughly four times the income of $4,864.

According to the report, auto sales hit a record high in 2015, “but some drivers might be on the road to financial ruin.” Citing data from the Reserve Bank of New York, the report says auto loan balances have increased for 18 consecutive quarters, with total car debt of $1.05 trillion, with a “T”, as of Sept 30 last year.

Wilkes-Barre sat in the middle of the three cities from Luzerne and Lackawanna counties in the report. Scranton ranked 1,384th, while Hazleton ranked 1,728.

WalletHub encourages potential car buyers to take a few simple steps before purchasing, so their vehicle intended for mobility doesn’t become a financial anchor holding back spending on other needs.

“We recommend prospective car buyers get their free credit score,” the site says, “and leverage a car payment calculator to determine what they can afford and how long it would take to pay off their future auto loan.”