Click here to subscribe today or Login.

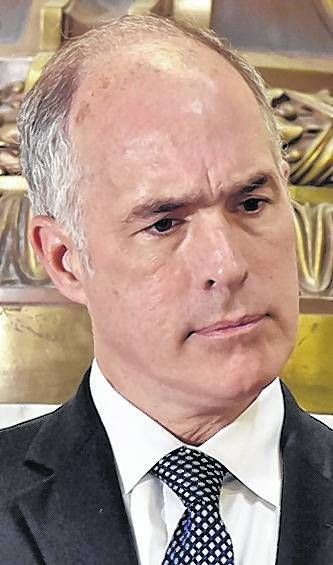

WILKES-BARRE — U.S. Sen. Bob Casey and Gov. Tom Wolf issued a simple statement Tuesday to the Republican-controlled Congress — don’t double tax the middle class.

During a tele-conference Tuesday the two Democrats blasted the GOP tax proposal they say would eliminate the state and local deduction (SALT) which helps subsidize key local projects.

The provision Casey and Wolf are concerned about deals with allowing state and local taxes — SALT — to be deducted from one’s income for federal tax purposes.

As it stands now, Casey and Wolf said Republicans in Washington are considering a budget and tax plan that would favor the wealthiest and large corporations over the middle class. Among other provisions, this proposal would eliminate SALT which is in place to ensure that families aren’t double taxed.

Casey and Wolf said in Pennsylvania, 52 percent (more than 800,000 people) of the 1.8 million taxpayers claiming this deduction make under $100,000. To highlight the importance of SALT for middle class families in Pennsylvania, Casey, D-Scranton, and Wolf hosted the conference call and called out the GOP proposal “for what it is.”

Casey has been a vocal opponent of the GOP proposal because, in addition to the elimination of SALT, it would:

• Raise taxes on some in the middle class by 2027.

• 80 percent of the tax benefits would go to the top 1 percent.

• The Republican budget could cut Medicare and Medicaid to pay for tax cuts for the super-rich.

“The Republicans in Washington are obsessed with getting more money into the hands of the wealthy,” Casey said. “The top 1 percent don’t need more tax breaks — they’ve been doing quite well for years and years.”

Steve Kelly, spokesman for U.S. Sen. Pat Toomey, R-Lehigh Valley, said the state and local tax deduction incentivizes state governments to raise taxes while overwhelmingly benefiting the wealthiest Americans.

“Nearly one-third of the total value of the state and local tax deduction benefit goes to wealthy Californians and New Yorkers, the two states with the highest taxes in the country,” Kelly said in an emailed statement. “Sen. Toomey does not support subsidizing big-spending, tax-hiking state and local politicians. He is working on a tax reform that will directly lower taxes on middle-income, hardworking Pennsylvania families and will not encourage other politicians to offset those savings with another tax hike.”

Casey said the Republican-controlled Congress is looking to trim billions from Medicare and Medicaid. “It’s wrong and obscene when you do that when you’re giving away so much to the top 1 percent.”

Wolf said doing away with the SALT provision would only put more burden on state taxpayers. He said he plans to talk to Pennsylvania members of Congress to encourage them to oppose the plan.

“It’s still not clear what the full plan will be,” Wolf said. “But it appears it will be a huge blow to middle class Pennsylvanians. Scaling back SALT should not be done to pay for tax breaks to the super wealthy. It simply doesn’t make sense, and it doesn’t help the economy.”

The Pennsylvania Democratic Party said the Trump/GOP tax plan hurts working families.

“While Americans around the country are bracing for President Trump and Congressional Republicans to roll out their tax plans, the consensus has been pretty clear — working families and the middle class will suffer under this disastrous policy,” the Democratic Party statement said. “Trump and Republicans have been working in secret to hide what the American people already know to be true — the Republican tax plan would increase taxes on the middle class.”

Casey, D-Scranton, is seeking his third term in the Senate next year. His likely opponent will be current U.S. Rep. Lou Barletta of Hazleton, a longtime Trump supporter.

Casey noted that Medicaid pays for health care for the disabled and for senior citizens needing long-term care.

Trump is expected to reveal his tax plan Wednesday.

According to an Associated Press story, Trump and congressional Republicans are seeking the first major tax overhaul in three decades, eager for a significant legislative achievement after being stymied in their attempts to repeal the Obama-era health care law. Enacting a tax package is seen as critical to helping Republicans maintain their majorities in the 2018 elections.

The head of the House tax-writing committee, Rep. Kevin Brady of Texas, has said that taxpayers will be able to continue to deduct local property taxes on their federal returns but the deduction for state income taxes would be repealed. The change means there would be three itemized deductions retained: for home mortgage interest, charitable donations and local property taxes.