Click here to subscribe today or Login.

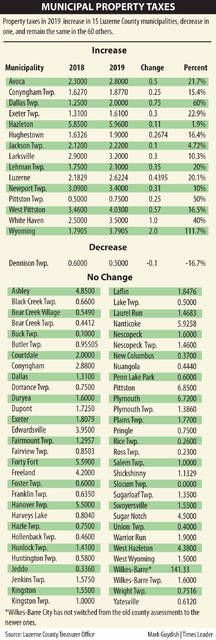

Property owners in 15 Luzerne County municipalities will pay higher real estate taxes in 2019, while one municipality opted for a decrease, according to a county treasurer’s office report.

Surpassing other tax-hiking municipalities by far is Wyoming Borough, with a tax rate that is more than doubling.

The owner of a $100,000 property in Wyoming will pay $200 more this year, with the municipal tax bill rising from $179 to $379.

Wyoming Councilman Michael Baloga said he could not bring himself to vote for such a high increase.

“It’s just a mess — a real mess,” he said of the borough’s financial situation. “We had mismanagement for many years. That’s what this stems out of.”

The state Department of Community and Economic Development has been assisting the borough in getting back on track and found Wyoming was behind on many bills and owes more than $370,000, which prompted the recommendation to raise taxes, Baloga said. The payment of some past bills with funds required for other purposes contributed to the problem, he said.

Baloga noted that prior borough manager Tamra Smith had resigned in November, and borough secretary/treasurer Roseanne Colarusso has been serving as interim manager since then. Smith could not be reached for comment for this article.

To help soften the tax-hike blow, council accepted Baloga’s proposal to reduce the borough’s sewer maintenance fee from $200 to $50, he said.

“I feel for the residents,” Baloga said.

Borough Councilman Joseph Scaltz said he understands a tax increase is the only solution because the borough is landlocked and has no other revenue stream to close the gap. However, he also voted against the hike because he thought it was too severe.

“I’m sad it has to come to this point,” said Scaltz, noting he was “tossed into the mix” because he started serving on council in December 2017.

In his review of finances this past year, Scaltz said he discovered poorly prepared budgets and accounts that were not reconciled. The borough is making “significant progress” addressing issues with help from the state and Colarusso, who has been working late hours to “straighten out the books,” he explained.

The goal is to eventually lower real estate taxes after fiscal problems are resolved, according to Scaltz and Baloga.

Specifically, the borough rate is rising from 1.7905 to 3.7905 mills, or 111.7 percent. Property owners must divide their assessed value by 1,000 and multiply it by the total millage rate to figure out their property tax bill.

Second highest

Dallas Township is next in line with a 60 percent increase, but township officials stress the rise is solely for a new fire protection tax that will not be spent on general operating expenses.

Township property owners will pay 2 mills, or 0.75 mills more, due to the fire protection levy, which will be listed separately on bills. The payment for a $100,000 property is rising from $125 to $200 — an increase of $75.

Fire protection receipts will be kept in a segregated account and monitored by an advisory committee that will include the township manager, both fire chiefs and two township residents, said township Manager Martin Barry.

Funds will help sustain the township’s volunteer fire departments — Kunkle Fire and Ambulance and Back Mountain Regional Fire and EMS — and purchase additional fire hydrants, which will help reduce insurance costs for property owners, Barry said.

Both volunteer fire companies asked township officials to provide increased financial support due to decreasing volunteers and receipts from fund drives and rising operating expenses, according to Barry.

Paid firefighters will be added to ensure coverage in the growing municipality, mainly during weekdays, although the specifics have not been finalized.

“People need to understand there’s a cost to providing fire protection, and that cost is rising,” Barry said, noting fire departments also provide assistance in many emergencies. “More areas are going to paid staff.”

Demand for police

Tax hikes in at least three municipalities — Exeter, Lehman and Newport townships — are primarily or solely to bolster police protection, officials said.

Lehman Township Supervisor David Sutton said his municipality has struggled to attract part-time officers, which puts stress on full-timers and the overtime budget.

The 20 percent tax increase, which equates to $35 more on a $100,000 property, will generate approximately $100,000 and fund an additional full-time police position, reducing reliance on part-timers, Sutton said. This will bring the force to six full-timers, although two are assigned to work in schools with reimbursement paid to the township, he said.

Sutton believes residents support around-the-clock protection.

“Believe it or not, crime is increasing, even in our rural township,” he said. “The opioid crisis is hitting us, too.”

Newport’s 10 percent increase, which amounts to $31 more for a $100,000 property, is funding two more officers, bringing the full-time count to four, said Joe Hillan, the township’s administrative operations director.

Hillan said his township also had difficulties recruiting part-timers.

The Exeter Township secretary said the 23 percent increase there will largely cover a police department reorganization adding an additional full-time officer and more part-timers, upgrading police equipment, and possibly adding a new vehicle. With the new officer, the township has two full-timers and around seven part-timers, the secretary said.

Flood buyouts

Conyngham Township Supervisor Ed Whitebread blamed his municipality’s 15.4 percent increase on a loss of revenue due to flood buyouts. The hike will cost a $100,000 property owner $25 more and generate approximately $8,000 more for the township overall.

More than 80 properties vulnerable to Susquehanna River flooding have been torn down since 2012, reducing the tax base, he said.

“More are coming down. We have fewer property owners paying for the same services,” explained Whitebread.

Township officials want to create infrastructure access to land on higher ground to attract new development, but they don’t have the financial means to fund that work at this time.

Buyouts and assessment appeal reductions also contributed to West Pittston’s 16.5 percent increase, said borough Manager/Treasurer Savino Bonita.

More than 20 flood-prone structures have been demolished since 2013, he said. The borough’s real estate tax base decreased $1.6 million compared to 2018, which equates to a $7,500 revenue loss, he said.

The tax increase also will cover $115,600 in rising expenses, including higher commercial and workers’ compensation premiums and pension subsidies.

The other municipalities with 2019 increases and the percentage taxes are rising, according to the county: Avoca, 22 percent; Hazleton, 1.88; Hughestown, 16.4; Jackson Township, 4.7; Larksville, 10.3; Luzerne, 20.1; Pittston Township, 50; and White Haven, 40.

Decrease in Dennison

Dennison Township officials reduced their municipal tax rate by 16.6 percent, lowering the total bill on a $100,000 property from $60 to $50.

Township Supervisor Michael Mack said his municipality has fire protection, buys police coverage from White Haven and does not have to invest in recreation opportunities because it houses the Nescopeck State Park. The township has also built a modest reserve for repairs and emergencies.

“We’re able to provide all the necessary services, and we’re careful how we spend our money,” Mack said. “Why take money from people and have it just sitting in an account?”

Slocum Township remains the only municipality with no local real estate taxes. Officials there have been trying to survive on state liquid fuels funding and wage tax revenue.

There is no tax increase or decrease in the 59 remaining municipalities.

Municipal tax bills are set to be mailed in early February.