Click here to subscribe today or Login.

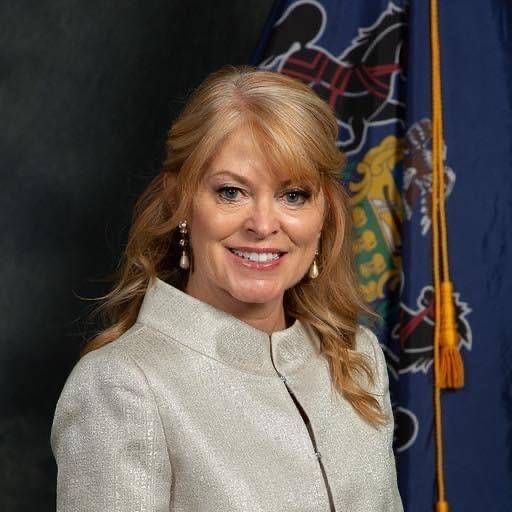

WILKES-BARRE — Treasurer Stacy Garrity this week said Pennsylvania has a rich history of manufacturing that dates back to before the American Revolution, and manufacturers are vital to the state’s economy.

Garrity announced a new social media campaign — #MadeInPAMondays — to highlight the amazing work being done by manufacturers and makers across Pennsylvania.

The #MadeInPAMondays campaign kicked off on Instagram (@PATreasury) by featuring Military Apparel Company, an Adams County company that sells handmade duffel bags, handbags, scarves, teddy bears, pet leashes and more, all crafted from personal military uniforms.

“They give back in so many ways, from producing the goods we need in our daily lives to contributing tens of billions of dollars to our economy,” Garrity said. “I’m excited to recognize manufacturers and makers of all kinds — from a single person building furniture in a small woodshop to large companies with hundreds of employees – through this social media campaign.”

David N. Taylor, President and CEO of the Pennsylvania Manufacturers’ Association, applauded the #MadeInPAMondays campaign.

“Manufacturing is the engine that drives Pennsylvania’s economy, adding the most value, having the strongest multiplier effect on job creation, and providing the best wages and benefits in the marketplace,” Taylor said. “We are so proud of Treasurer Garrity, who is herself a manufacturer, and salute her campaign to showcase Pennsylvania’s amazing manufacturers and all of the things that are made in the commonwealth.”

Garrity said manufacturing jobs account for 10 percent of Pennsylvania’s employment, and the manufacturing sector generated about $93 billion in economic activity in 2019 — up from $87 billion in 2018, according to the Pennsylvania Manufacturers’ Association.

Pennsylvania’s maker community is large and growing, with makerspaces across the state encouraging creativity in fields as diverse as 3D printing, CNC machines, electronics, jewelry, robotics, textiles and woodworking.

RNC Roundtable

Earlier this week, Garrity was in Clarks Summit with representatives of the Republican National Committee to host a small business roundtable with local businesses.

Allie Carroll, Pennsylvania Communications Director for the RNC, said during the roundtable, several issues were discussed, including Pennsylvania’s economy:

Garrity said Pennsylvania is in the bottom half of states for the percentage of lost jobs from the pandemic.

Low-income Pennsylvanians can

benefit from Tax Forgiveness program

With the personal income tax filing deadline approaching on May 17, 2021, the Department of Revenue is reminding low-income Pennsylvanians that they may be eligible for a refund or reduction of their Pennsylvania personal income taxes through the commonwealth’s Tax Forgiveness program.

About one in five households qualify for Tax Forgiveness and it is a benefit commonly received by retirees and low-income workers. However, every year there are hundreds of thousands of eligible Pennsylvanians who do not take advantage of the program because they fail to file a Pennsylvania Personal Income Tax Return (PA-40) to claim the reduction or refund on their taxes.

“In recent years, the Tax Forgiveness program has annually delivered refunds totaling more than $240 million to more than 1 million Pennsylvanians. But the reality is that many more people could be taking advantage of this benefit,” said Revenue Secretary Dan Hassell. “If you have a neighbor, friend or family member whom you think may be eligible for this program, please encourage them to check their eligibility and file a tax return with our department. We want to reach as many Pennsylvanians as possible to make them aware this program exists.”

A family of four (couple with two children) can earn up to $34,250 and qualify for Tax Forgiveness. Meanwhile, a single-parent, two-child family with income of up to $27,750 can also qualify for Tax Forgiveness. Visit the Tax Forgiveness page on the Department of Revenue’s website for further eligibility information, including eligibility income tables.

Using the most recent data available, the Department of Revenue estimates there are at least 380,000 Pennsylvania taxpayers who would qualify for Tax Forgiveness but fail to file an income tax return with the commonwealth to claim the benefit. That estimated number could be much higher depending on the number of children eligible taxpayers have. These people are missing out on refunds ranging between $10 and $1,000.

“A refund of any amount helps low-income, working taxpayers who may be stretched thin,” Hassell said. “That could be especially true this year due to the fact that our most vulnerable citizens have been the ones hardest hit by the COVID-19 pandemic.”

DHS Life program helps seniors

live in their homes/communities

The Department of Human Services (DHS) this week announced that Pennsylvanians seeking long-term services and supports through the LIFE (Living Independence for the Elderly) Program will now be able to apply for and enroll in these programs directly through the Medical Assistance Independent Enrollment Broker.

By implementing this streamlined enrollment process, interested seniors and their loved ones can request information online at — https://www.enrollchc.com/enroll — or over the phone by calling 1-844-824-3655. Those who prefer to submit a paper application can print it from the website and mail it to Community HealthChoices, PO Box 61440, Harrisburg, PA 17106.

“We want to do everything we can to make it easier for Pennsylvania’s seniors to get the services and supports they need, and this new enrollment process will do just that,” said Acting DHS Secretary Meg Snead. “All Pennsylvanians deserve to age in place in their community with family and peers as they are able. The Wolf Administration is committed to serving people in the community, and we are excited that LIFE programs around Pennsylvania help make this even easier to achieve.”

With this change, participants will have a one-stop shop for information about the LIFE program and other long-term care programs, allowing them to make a more informed choice about how they would like to receive services. Participants will also receive in-person counseling and educational materials for more information on the LIFE program and Pennsylvania’s managed long-term services and supports program, Community HealthChoices.

Many older Pennsylvanians wish to continue living in their homes and their communities for as long as economically and medically feasible.

Pennsylvania’s LIFE program is an all-inclusive long-term managed care program that enables participants to stay out of nursing homes and remain in their own homes and communities and live happier, more productive, and more fulfilling lives.

LIFE currently serves approximately 7,500 Pennsylvanians in 53 counties. DHS plans to expand the LIFE program statewide over the next few years.

AG Shapiro announces changes

to improve student fees collections

Attorney General Josh Shapiro this week announced that the Pennsylvania Office of Attorney General (OAG) is taking more steps to improve the ease and convenience of paying back student fees for Pennsylvanians.

Effective May 5, 2021, $17,961,238.17 in fees owed to the Commonwealth from 4,760 Pennsylvania State System of Higher Education (PASSHE) students will be recalled to OAG from private collection agencies. The Pennsylvania Office of Attorney General is required by law to collect outstanding debts owed to the Commonwealth.

“Access to higher education is already a barrier for far too many in our Commonwealth,” Shapiro said. “Our goal is to make it easier for Pennsylvanians to improve their lives through college — not send them to collections, hurt their credit, and prohibit them from making themselves whole by forcing them to pay by cashier’s checks and money orders. This announcement is just one step towards easing the financial burden on Pennsylvania’s students, and there will be more to come.”

Shapiro said the Commonwealth will no longer send outstanding student fees to for-profit debt collectors, and efforts by a university to send student fees to for-profit debt collectors before more consumer-friendly efforts are attempted will no longer be approved.

Upon taking office, Shapiro directed the office to make the collection of outstanding debts to the Commonwealth more consumer friendly; the office works to implement payment plans and accepts personal checks from individuals instead of requiring these debts be paid by punitive, high-fee, money orders or cashier’s checks.

The Office of Attorney General is entrusted by law to oversee the collection of outstanding debts to the Commonwealth, including PASSHE schools. The office will also be implementing an online system for people to make these payments no later than 2022.

Reach Bill O’Boyle at 570-991-6118 or on Twitter @TLBillOBoyle.